Market Fear

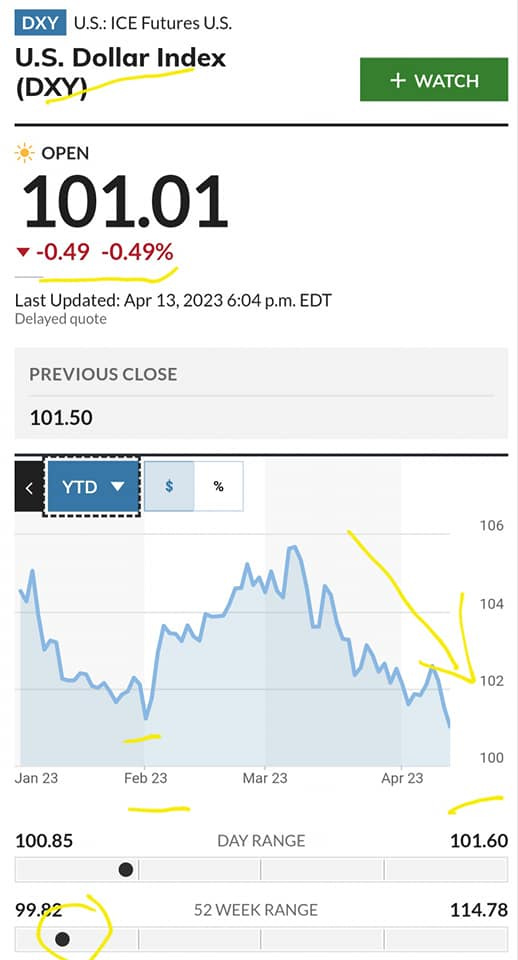

US dollar continues to fall relative to other Western fiat currencies, breaking February 2023 trend line, which suggests a break further down.

The Federal Reserve has reversed its balance sheet tightening by adding to it in order to contain the banking crisis via bailouts.

US core inflation increased to 5.6% in March 2023 and overall inflation CPI leveled out at 5%. These numbers do not yet reflect the surge in oil prices.

Commodities, precious metals continue to surge higher as fear pervades the markets from the banking crisis, inflation, and unsound economic fundamentals including excessive debt and rapidly high interest rates. The increase commodity spot prices, which are priced in US dollars, reflect as well the devaluation of the dollar.

The trajectory is for stagflation: "persistent high inflation combined with high unemployment and stagnant demand." Gold as a safe haven asset performs best in this killer combination.

De-dollarization, geopolitical uncertainty, and the globalists push for technocratic transformation are adding to the building economic crisis.

The fall in the dollar value hurts the average American most by reducing their purchasing power.

The US national debt close to $32 trillion looms large.

How can any reasonable person have confidence in the globalist establishment and ultimately the central banks (which are focused on central bank digital currency)?

Stephen.Garvey@EmergingGlobalRealities.com