De-dollarization and the emergence of a new bipolar world

There is no denying de-dollarization in terms of a growing global phenomenon:

Russia conducts trade in its own currency ruble and that of its friendly countries' currencies such as the Indian rupee, and/or in exchange for gold. The trade between Russia and India has grown to more than $40 billion.

Significantly, trade between China and Russia (in excess of $190 billion) is in their own currencies. And Russia encourages countries to conduct trade using the Chinese yuan.

China completed a mega LNG deal (65,000 tons) with UAE that will be settled in the yuan. (End of the US petro dollar).

China brokered the Saudi Arabia Iran peace deal, and Saudi Arabia is considering the purchase of oil settled in yuan, and Iran trades with China (in excess of $16 billion) settled in yuan.

China signed a mega trade deal with Brazil worth $150 billion in trade that will be settled using their own currencies.

India and Malaysia agree to settle their trade (in excess of $7 billion) in Indian rupee.

Brazil and Argentina are working on a common currency.

Indonesia is working on using local currencies to settle trade transactions.

The weaponization of the US dollar via rules-based (political) sanctions has accelerated de-dollarization, as has the abuse of the US reserved currency via massive money creation at the expense of the global east and south.

BRICS is working on an alternative currency that will be backed by gold or a basket of commodities to the US dollar.

BRICS is set eventually to expand with Algeria, Argentina, Iran, Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand, and United Arab Emirates, and Turkiye, Egypt, Mexico, Saudi Arabia and Afghanistan are interested in joining BRICS.

The expanded BRICS would be in excess of "30% larger than the US GDP, over 50% of global population, and control 60% of global gas reserves."

Countries that do not trade in the US dollar will be immune to most US sanctions. Trade tariffs would still be applicable to be used by the collective West as a weapon.

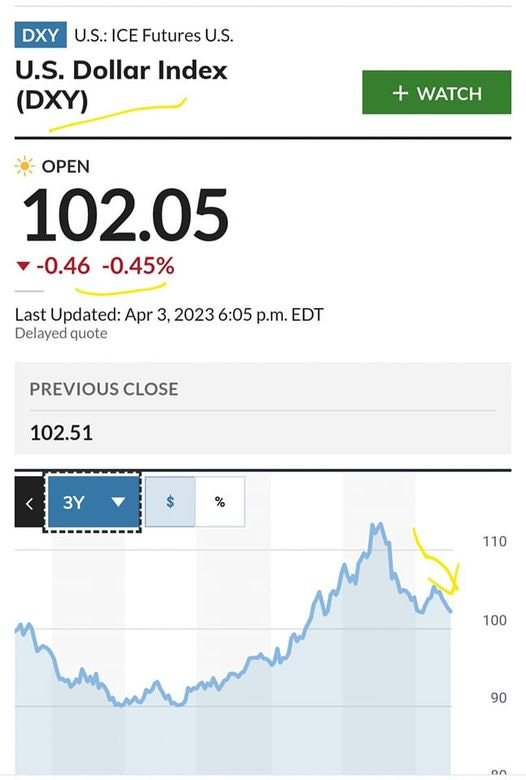

The US dollar as shown in the graph continues to fall amdist the Western banking crisis, high inflation, cornered federal reserve causing a pause in interest rate hikes, growing unsustainable US debt that approaches $32 trillion, geopolitical uncertainty, de-dollarization...

The biggest winner of de-dollarization is the global east south majority, and the biggest loser will be the American and Western people as a whole as their purchasing power will plummet causing a significant decline in quality of life. The Western fiat economic system faces collapse due to massive debt in the tens of trillions and decline in production versus consumption.

The impact of de-dollarization will occur incrementally and shown directly by the decline in the value of the dollar.

Is this dollar decline according to plan to reduce the cost of US debt (by weakening the value of the dollar) and usher in the technocratic reset including digitalization?

How will the US neocons/neoliberals respond to the end of US hegemony via the US rules-based world order?

Stephen.Garvey@EmergingGlobalRealities.com